The global tungsten supply has a profound impact on radiation shielding technology, as tungsten’s unique properties—high density, exceptional radiation attenuation, and non-toxicity—make it a cornerstone material for shielding applications in medical, industrial, and nuclear sectors. With roughly 80% of the world’s tungsten output concentrated in China, fluctuations in supply, pricing, and export policies ripple through industries reliant on this metal, shaping the development, cost, and accessibility of shielding solutions. Let’s unpack how this dynamic influences radiation shielding technology.

Tungsten’s Role in Shielding Technology

Tungsten alloys (e.g., 95W-Ni-Fe, ~18 g/cm³) outperform lead and other materials in gamma radiation shielding due to their density and atomic number (Z=74), which enhance photoelectric absorption, Compton scattering, and pair production. A 30 mm tungsten shield can reduce Co-60 gamma rays (1.17-1.33 MeV) by over 90%, compared to 40 mm of lead or 200 mm of concrete. This efficiency allows for compact, durable shielding—think teletherapy heads, brachytherapy afterloaders, or nuclear casks—critical where space and safety intersect. Unlike lead, tungsten’s non-toxic nature aligns with environmental regulations, driving its adoption as a “green” alternative.

Supply Concentration and Vulnerability

China’s dominance—producing ~80% of global tungsten (estimated at 83,000 metric tons in 2023, per USGS)—creates a chokehold on supply. The U.S., Europe, and other regions import heavily, with limited domestic production (e.g., the U.S. output is under 1,000 tons annually). This reliance exposes shielding technology to:

- Export Restrictions: China has tightened controls on critical minerals, including tungsten, citing national security. Posts on X and Bloomberg reports highlight concerns over potential curbs on tungsten scrap exports, further constricting availability.

- Price Volatility: Supply constraints spike prices—tungsten concentrate hit $30,000-$35,000 per ton in recent years, up from $20,000 pre-2020. Higher costs trickle down to shielding products, raising expenses for hospitals, nuclear plants, and manufacturers.

- Stockpiling Risks: Western nations, like the U.S. with its National Defense Stockpile, hold limited reserves (e.g., ~10,000 tons), inadequate for sustained disruption.

Impacts on Technology Development

- Cost-Driven Innovation

Expensive tungsten pushes research into alternatives or efficiency. Composites like tungsten-polymer blends or hybrid shields (e.g., tungsten-bismuth fabrics) aim to reduce tungsten use while maintaining performance. A study showed a tungsten-PDMS composite improved shielding by 17% over lead sheets, with 53% higher tensile strength—progress spurred by cost pressures. However, these alternatives often lag in density and scalability, keeping tungsten dominant. - Supply Chain Delays

Shielding tech relies on timely tungsten delivery for custom holders or mass-produced PPE (e.g., radiology aprons). Export slowdowns—like those hinted at in X posts about China’s mineral clampdowns—delay projects. A radiotherapy unit needing a 20 kg tungsten collimator could face months-long setbacks, stalling cancer treatment deployment in clinics. - Regional Disparities

China’s control benefits its domestic industries, potentially accelerating shielding advancements there (e.g., cheaper tungsten carbide shields). Meanwhile, import-dependent regions face higher costs and slower adoption. Low-resource areas, reliant on affordable Co-60 teletherapy, may stick with bulkier lead if tungsten prices soar, widening tech gaps. - Fusion and Future Demand

Tungsten’s heat resistance and neutron moderation make it vital for fusion reactors (e.g., ITER’s plasma-facing components). X posts note that current output can’t meet rising demand from fusion tech, projected to grow 5-10% annually through 2030. Shielding for compact spherical tokamaks or next-gen nuclear plants could falter if supply doesn’t scale, stunting decarbonization efforts.

Strategic Responses

- Diversification: Countries like Australia (e.g., King Island mine) and Spain (e.g., Almonty’s Sangdong project) are ramping up production, targeting 5,000-10,000 tons annually by 2026. This could ease reliance on China, stabilizing shielding supply chains.

- Recycling: Tungsten’s recyclability—30-50% globally—is underutilized in shielding. Scrap from old holders or industrial tools could offset shortages, though collection lags.

- Stockpiling: Nations may expand reserves, but this diverts funds from R&D, slowing tech breakthroughs.

Environmental and Ethical Angles

Tungsten mining, concentrated in China, carries environmental costs—energy-intensive extraction (e.g., 50-100 MJ/kg) and habitat disruption. Yet, its non-toxicity in shielding applications contrasts with lead’s disposal woes, making supply security a sustainability issue. Ethical concerns, like labor conditions in Chinese mines, also push Western firms to seek alternatives, though viable substitutes remain elusive.

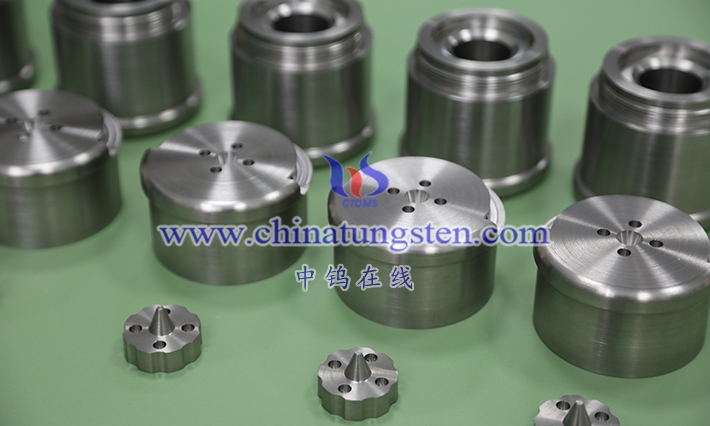

Customized R&D and Production of Tungsten, Molybdenum Products

Chinatungsten Online and CTIA GROUP LTD have been working in the tungsten industry for nearly 30 years, specializing in flexible customization of tungsten and molybdenum products worldwide, which are tungsten and molybdenum design, R&D, production, and overall solution integrators with high visibility and credibility worldwide.

Chinatungsten Online and CTIA GROUP LTD provide products mainly including: tungsten oxide products, such as tungstates such as APT/WO3; tungsten powder and tungsten carbide powder; tungsten metal products such as tungsten wire, tungsten ball, tungsten bar, tungsten electrode, etc.; high-density alloy products, such as dart rods, fishing sinkers, automotive tungsten crankshaft counterweights, mobile phones, clocks and watches, tungsten alloy shielding materials for radioactive medical equipment, etc.; tungsten silver and tungsten copper products for electronic appliances. Cemented carbide products include cutting tools such as cutting, grinding, milling, drilling, planing, wear-resistant parts, nozzles, spheres, anti-skid spikes, molds, structural parts, seals, bearings, high-pressure and high-temperature resistant cavities, top hammers, and other standard and customized high-hardness, high-strength, strong acid and alkali resistant high-performance products. Molybdenum products include molybdenum oxide, molybdenum powder, molybdenum and alloy sintering materials, molybdenum crucibles, molybdenum boats, TZM, TZC, molybdenum wires, molybdenum heating belts, molybdenum spouts, molybdenum copper, molybdenum tungsten alloys, molybdenum sputtering targets, sapphire single crystal furnace components, etc.

For more information about tungsten alloy products, please visit the website: http://www.tungsten-alloy.com/

If you are interested in related products, please contact us:

Email: sales@chinatungsten.com|

Tel: +86 592 5129696 / 86 592 5129595